Profit during crashes and retracements! Shorting with Salsa Signals!

Crypto volatility is the reality of every trader’s world. Every big rally is inevitably followed by a retracement or flash crash – that’s just how the flow of the market works.

To avoid experiencing loss when this happens, you can, instead, leverage a concept called “short selling” that allows you to make money while prices are falling – all without owning the asset.

Let Salsa Signals help you take advantage of this type of trading!

What does “Shorting a Coin” mean?

Firstly, the reason it’s called short selling is that you’re “short” of the coins – you don’t actually own the coins from which you intend to profit. In simple terms, when you open your position, you are borrowing the coins and selling them immediately at the current market price, expecting them to fall. When the price does fall, you then buy the coins at the lower price and then give back the coins that you borrowed. Your profit is the difference between your selling and buying prices.

Shorting is a way to profit off the decline in an asset’s value instead of waiting for it to reach an estimated bottom before entering a position and profiting only from its increase in value.

How to short Cryptocurrency.

First of all, you’ll need to decide which exchange to use for your Short Trading. You’ll need to bear in mind the statutory regulations of your country, the variety and availability of trading pairs, the trading volume and maximum liquidity on the exchange you are considering. Exchanges that allow shorting include Bybit, Binance, Kucoin, OKX, and Bitfinex. Most exchanges will also require you to KYC (Know Your Customer verification) and work on the basis of requiring you to fund your main or spot account, then transfer funds to your derivatives or margin account for short or leverage trading.

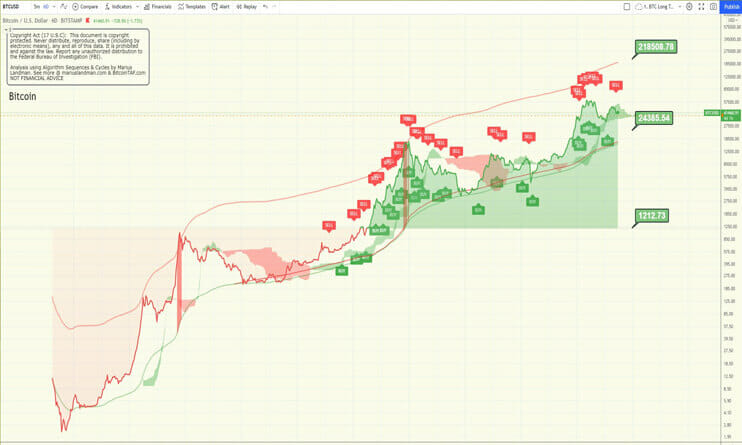

At SALSA Signals, our exchange of preference is Bybit Exchange, and our Short Signals are mapped out clearly for you on Bybit charts in Tradingview. In the example below, we anticipated a decline in price and recommended an entry position at $6.415.

:

In practice, the following steps would have been taken

1. On Bybit, select Derivatives / USDT Perpetual / CVXUSDT

(We find it quicker to select BTCUSDT, and then select eg. CVXUSDT after landing on the BTCUSDT chart).

2. At the top right, select “Isolated” (not Cross) and set your x(leverage). At SALSA we trade maximum x3 leverage. (screenshot below)

3. Then, select Limit or Conditional order, (screenshot below) enter your order price (or trigger price in case of a conditional order) eg. 6.415, enter the number of coins you want to buy or select the percentage of your available USDT you want to spend on the trade, then click on “Open Short” / “Confirm”.

4. If you tick the “Sell short with TP/SL” box above the red “Open Short” button, you will be able to set up your entire trade – that is, add your stop loss and selling price simultaneously while placing your Sell order. If you don’t tick the box, you will be able to do this after your order has been filled by clicking on the Pencil below TP/SL in the “Positions” pane below the chart.

5. You will be able to edit your position, stop loss and take-profit target for the full duration of the trade. In addition, Bybit also allows you to add a trailing stop loss.

The above is a truly simplified explanation of opening a short position on Bybit, and several other methods are available on this extremely user-friendly exchange.

If you would like to learn more about how to trade a short on Bybit, the risks involved and how it can be of benefit to you, please join us on Friday 22 July 2022 for a comprehensive coaching session presented by SALSA Signals. Our Analysts will demonstrate the process of entering a position and managing a Short, leveraged trade.

A Zoom link to the webinar is available on the events page of Bitcoin Trend and Forecast: https://bitcointaf.com/pages/events

Let’s maximise our profits! See you all there!

Disclaimer

This report/chart/video is provided for informational purposes only. It is not an offer or a solicitation of an offer to buy or sell any financial instruments or participate in any particular trading idea or plan.

Safe Zone Entry/Target Points, Entry and Exit figures/levels/zones are BTAF Analysts’ own personal buy and sell zones, and in no way is BTAF or their Analysts suggesting you follow these exit and entry points.

For a full breakdown, please read our Terms and Conditions here :

https://cdn.bitcointaf.com/terms_and_conditions/69657112870.pdf