In the whirlwind world of cryptocurrency, where fortunes flip faster than a meme coin pump, Decentralized Finance (DeFi) stands as the rebel force rewriting the rules. Enter Day Trade Masters (DTM), the premium subscription service from BitcoinTAF.com that’s turning heads with its laser-focused DeFi strategies. As we hit November 2025, with the crypto market ballooning to $4 trillion amid explosive AI integration and a surge in DeFi exchanges and wallets, DTM isn’t just surviving—it’s thriving. But why bet big on DeFi over the shiny centralized exchanges (CEXs)? Let’s dive in and unpack how DTM’s approach is delivering consistent wins in this hyper-evolved landscape.

The DTM DeFi Blueprint: Adaptable Strategies for Volatile Markets

At its core, DTM is all about empowering intermediate to advanced traders with real-time signals, educational tools, and a “be like water” philosophy inspired by Bruce Lee—adapting fluidly to market flows without rigid structures like automated stop losses. Their dual-strategy system shines here:

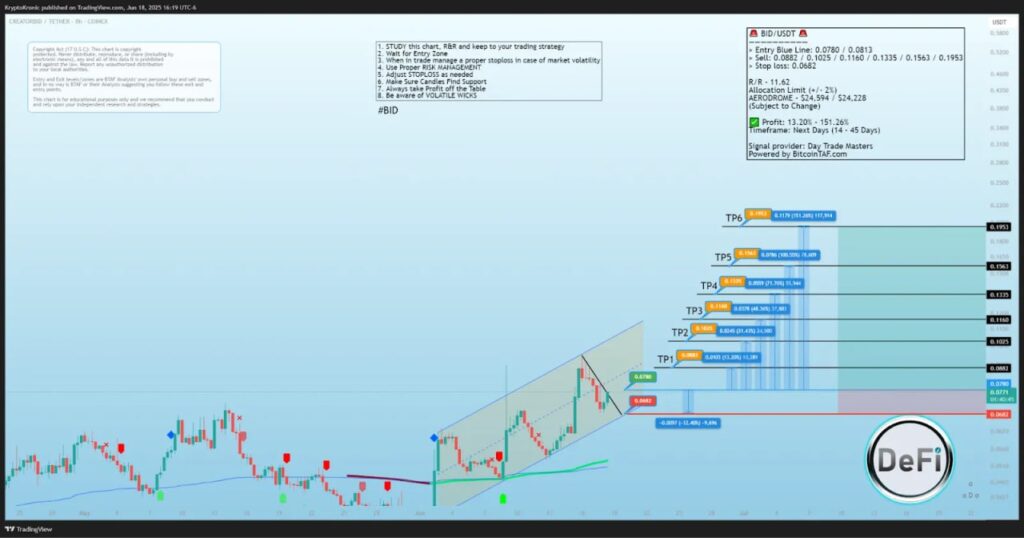

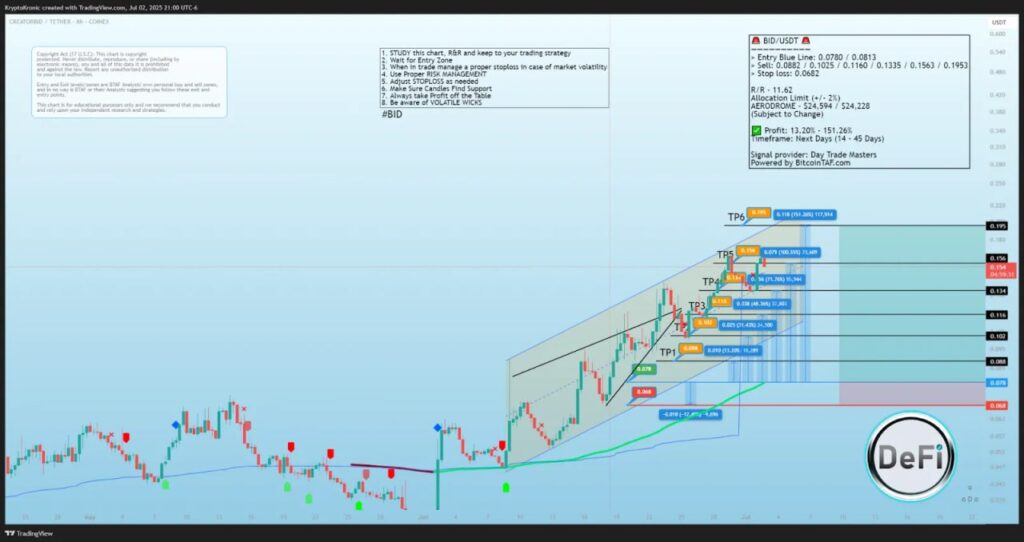

Day Trade Setups – Monitored every 8 hours with executions on 4 hour charts, these target rapid profits in choppy or upward markets. Think quick compounding gains while dodging downside risks, ideal for sideways chops or selective bearish dips.

DeFi Swing Setups – With 8-12 hour monitoring and 8 hour executions, these give coins more breathing room for bigger upsides in bull runs. They’re less hands-on but pack punchier returns when momentum builds.

What ties it all together? Dollar Cost Averaging (DCA) within precise entry zones, buying on dips and selling on rallies to average costs and counter DeFi’s notorious volatility and bots (like front-runners). Risk management relies on Telegram alerts, chart rebuilding, and opportunistic exits—DTM’s analysts handle the heavy lifting, posting entries, exits, and updates in dedicated channels. They crunch Fibonacci levels, supply/demand zones, and historical data for setups, often projecting 13-150% profits over 14-45 days.

Focusing on low-fee chains , DTM recommends certain wallets for EVM networks as well as for Solana. Tools like CoinGecko for price verification keep things efficient. No wonder their claimed 88% win rate from 2023 still echoes in reviews—users rave about cumulative gains like 1,275% and the blend of signals with education via courses like the Ultimate DeFi Course.

Thriving in 2025: AI Boom, DeFi Expansion, and DTM's Edge

Fast-forward to late 2025: The crypto scene is on steroids. DeFi’s Total Value Locked (TVL) has smashed records at $237 billion, fueled by institutional adoption, stablecoin surges (over $772 billion in monthly transactions on Ethereum and Tron), and APAC’s 69% year-over-year growth in on-chain activity. Mobile-first DEXs have onboarded 1.2 million new users, with platforms like Uniswap, Aerodrome, and Raydium leading the charge in permissionless lending and tokenized Real-World Assets (RWAs).

Enter AI, the game-changer supercharging DeFi. In 2025, AI-driven protocols are everywhere: optimizing risk assessments, automating trades, predicting yields, and sniffing out fraud with machine learning. Tokens like Sahara AI and projects on NEAR are blending AI with blockchain for decentralized inference and data processing, driving 16.4% quarterly market growth. AI agents are transforming portfolios by analyzing data, optimizing DeFi yields, and even executing trades autonomously.

How does DTM fit in? Their human-led signals complement AI trends perfectly—while AI handles predictive analytics, DTM’s real-time alerts and adaptive strategies fill the gaps in volatile, bot-heavy DeFi environments. Recent X updates from @Day_TradeMaster show consistent hits, like 27.64% on DIA/USDT and 223% across signals, even in “dead” markets. With weekly webinars, strategy updates every 45-90 days, and a mobile app, DTM users are navigating the AI-DeFi fusion with ease. Reviews on Trustpilot (4/5 overall) and their site (5/5) highlight reliability: “Profitable signals and clear analysis” amid a market where DeFi 3.0’s efficiency is drawing trillions. It’s working *exceptionally* well—DTM’s 2-10+ setups per week are capitalizing on the explosion of wallets (e.g., collaborative social wallets) and DEXs, turning AI-enhanced opportunities into tangible gains.

Why DTM Ditches Centralized for DeFi: The Freedom Factor

Centralized exchanges like Binance or Coinbase? DTM says “thanks, but no thanks.” The shift makes sense in 2025’s regulatory minefield and hack-prone CEX landscape. DeFi’s non-custodial nature means you hold your keys— no handing over funds to a third party that could get rugged or frozen. Smart contracts execute trades transparently, slashing fees (sub-$0.01 on Solana) and eliminating intermediaries for true financial sovereignty.

Traders flock to DeFi for privacy (no KYC hassles), speed (sub-second finality on Solana vs. Ethereum’s delays), and resilience— even if a DEX glitches, your wallet stays safe. With DeFi perps like Hyperliquid grabbing 64% market share and projections of DeFi overtaking CEXs this year, it’s a no-brainer. DTM’s DeFi-centric model avoids CEX risks like custody breaches or regulatory clamps, aligning with the “democratize wealth” ethos. As one trader put it: “Swaps diversify faster, with less trust required.”

The Verdict: Ride the DeFi Wave with DTM

In an AI-fueled 2025 where DeFi is the beating heart of crypto’s mainstream push, Day Trade Masters isn’t just keeping up, it’s leading the charge. Their blend of proven strategies, real-time guidance, and DeFi purity delivers results that centralized setups can’t match. If you’re tired of trading alone, check out DTM’s subscriptions (monthly or annual with discounts) and courses at bitcointaf.com. The next run won’t wait—adapt, thrive, and let DeFi set you free.