Secrets of Elliott Wave Algorithms

Welcome to BitcoinTAF.com! In this blog post, we will delve into the fascinating world of Elliott Wave Algorithms and explore how they can provide valuable insights into the price movements of cryptocurrencies, particularly Bitcoin and, recently, what occurred with BitcoinCash. Understanding these algorithms can significantly enhance your trading strategy, whether you are a seasoned trader or a curious enthusiast. Let’s dive in!

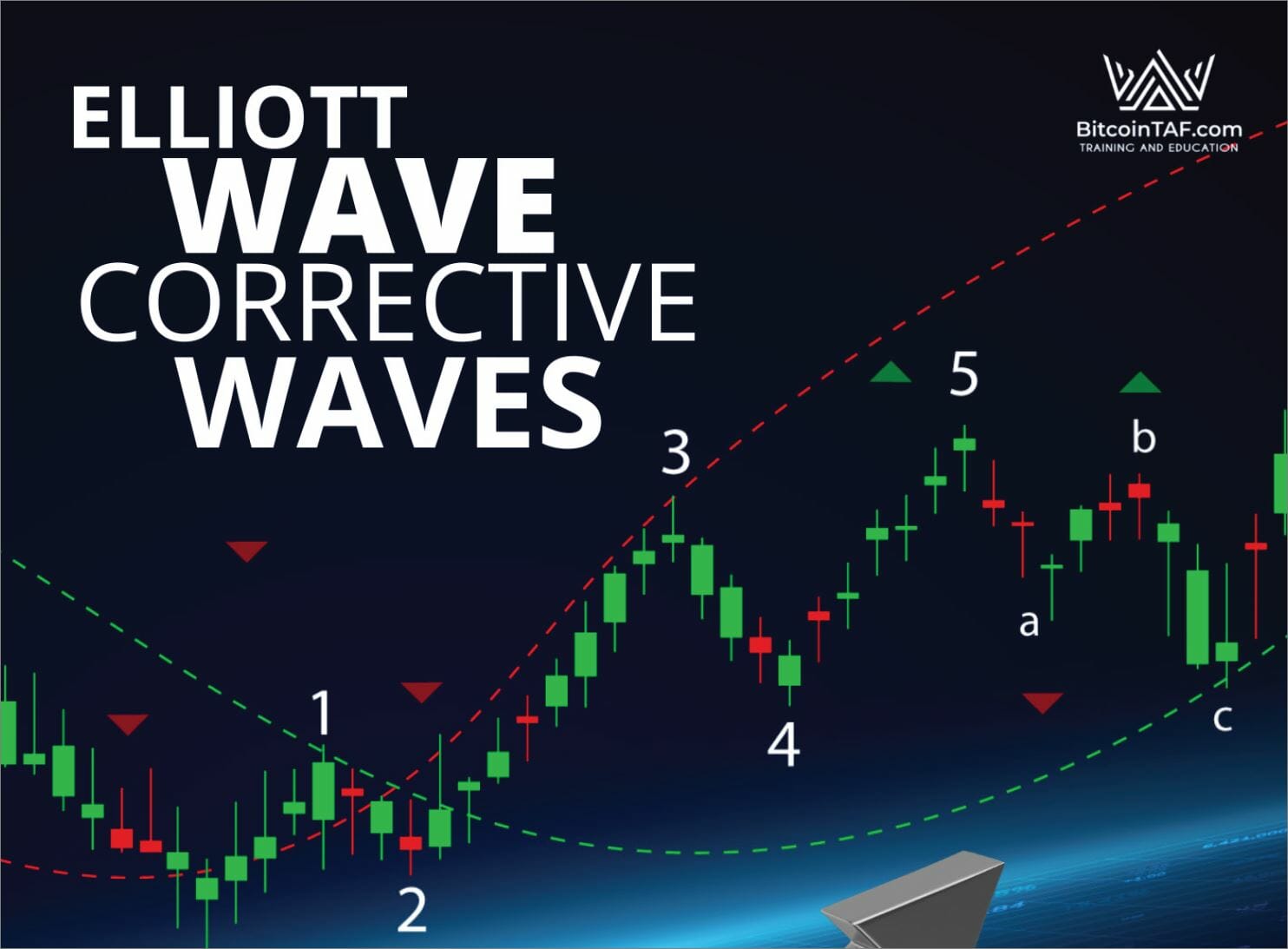

Understanding Elliott Wave Theory:

Elliott Wave Theory, developed by Ralph Nelson Elliott in the 1930s, is a powerful tool for analysing market cycles and predicting future price movements. The theory suggests that financial markets, including Bitcoin, move in repetitive patterns of five upward and three downward waves. These waves, driven by human psychology and market sentiment, create trends and corrections that can be deciphered using specialised Elliott Wave Algorithms. The Bitcoin Algorithm Cycle was first developed by Marius Landman in 2016. The best possible pathway or scenario for price action can be predicted using both Elliott Wave Principals and Algorithm Cycles. And here at BitcoinTAF.com, that s exactly how we predicted that BitcoinCASH would make a 258% price jump.

The Role of Algorithms in Elliott Wave Analysis:

While Elliott Wave Theory lays the foundation, manually identifying and interpreting wave patterns can be complex and time-consuming. This is where Elliott Wave Algorithms come into play. These advanced mathematical algorithms are designed to analyse price data, identify wave patterns, and generate accurate predictions based on historical price movements and patterns. Using these algorithms, traders can gain a deeper understanding of the market and make well-informed decisions.

How we predicted a 258% price jump for BitcoinCASH and took advantage of it.

Benefits of Elliott Wave Algorithms:

Objective Analysis: Human emotions and biases can often cloud judgment, leading to inconsistent analysis. Elliott Wave Algorithms eliminate these biases and offer objective insights into market trends.

Time Efficiency: Analysing complex wave patterns manually can be arduous and time-consuming. Algorithms can swiftly process vast amounts of data, providing traders with timely and relevant information.

Enhanced Accuracy: Elliott Wave Algorithms employ statistical models to forecast potential price levels and turning points with greater accuracy, aiding traders in making more precise entry and exit points.

To maximise the benefits of Elliott Wave Algorithms, traders should consider a multi-faceted approach:

Combine with Other Indicators: While powerful on their own, Elliott Wave Algorithms can be further strengthened by using them alongside other technical indicators like moving averages, RSI, or Fibonacci retracements.

Risk Management: Like any trading strategy, managing risk is crucial. Use stop-loss orders and position sizing to protect your capital during volatile market movements.

Continuous Learning: Mastering Elliott Wave Algorithms takes time and practice. Stay updated on market trends, attend webinars, and participate in trading communities to enhance your understanding.

Conclusion:

Elliott Wave Algorithms are potent tools that unlock the hidden patterns in cryptocurrency markets, offering traders invaluable insights and helping them make more informed decisions. By understanding Elliott Wave Theory and integrating these algorithms into your trading strategy, you can gain a competitive edge in the dynamic world of cryptocurrencies. Remember, practice and continuous learning are vital to harnessing the full potential of Elliott Wave Algorithms. Happy trading!

Disclaimer: The information provided in this blog post is for educational purposes only and should not be considered financial advice. Trading cryptocurrencies involves inherent risks, and past performance does not guarantee future results. Conduct thorough research and consult a professional financial advisor before making investment decisions.

Subscribe here to Elliott Wave Algorithms

Marius Landman

BitcoinTAF.com

Great blog post thank you

Thank you Wayne. We are happy that you found value in the content.