The financial world is changing at a pace never seen before, and those who fail to recognize market cycles risk being left behind. At BitcoinTAF.com, we’re at the cutting edge of trading intelligence, offering traders an unparalleled advantage through the Elliott Wave AI Algorithm—a game-changing tool designed to anticipate market moves. But there’s a considerable disparity between Bitcoin and the ALT coins, and during the weekly live Zoom calls, we discuss these challenges. Once you get what is happening, the rest is as easy as sailing a boat in a breeze.

For those unfamiliar, Elliott Wave Theory isn’t just another indicator; it’s a deeply rooted mathematical principle that governs how markets move in repetitive cycles fueled by human psychology. Combined with AI-driven data analysis, it becomes a market weapon—helping traders catch the most significant moves before they happen.

Why the Elliott Wave AI Algorithm is a Game-Changer

Traditional Elliott Wave analysis relies on human interpretation, which can sometimes be subjective. But our AI-driven algorithm eliminates guesswork by scanning massive amounts of historical data, identifying repeating fractal patterns, and applying Wyckoff accumulation/distribution principles to detect the next explosive move in the market.

Here’s what sets the Elliott Wave AI Algorithm apart:

✅ Advanced Pattern Recognition – Identifies real-time wave formations and predicts the next impulse or corrective move.

✅ Wyckoff Accumulation & Distribution Analysis – Detects market manipulations, allowing traders to front-run whales before they make their move.

✅ Cycle-Based Projections – Uses AI to cross-analyze past Elliott Wave patterns with current data, increasing accuracy.

✅ Real-Time Alerts – Provides instant notifications when a major market shift is imminent.

✅ Institutional-Level Market Insights – A tool designed for serious traders who want deep, actionable analysis rather than lagging indicators.

Enhance Your Trading with BitcoinTAF's Exclusive Indicators

For even greater accuracy, traders using the Elliott Wave AI Algorithm should also incorporate BitcoinTAF.com’s proprietary indicators for maximum market precision:

🔥 HODLFIRE Indicator – Identifies top and bottom pivot points, helping traders make high-confidence entries and exits.

💥 Detonator ABC Indicator – Designed for day and long-term traders, this tool helps pinpoint key trade opportunities based on explosive market setups.

🔗 The Detonator ABC Indicator comes with the Ultimate Trading Course.

These indicators work with Elliott Wave analysis, allowing traders to execute more accurate trades and avoid emotional decision-making.

Understanding Elliott Wave Patterns: The DNA of the Markets

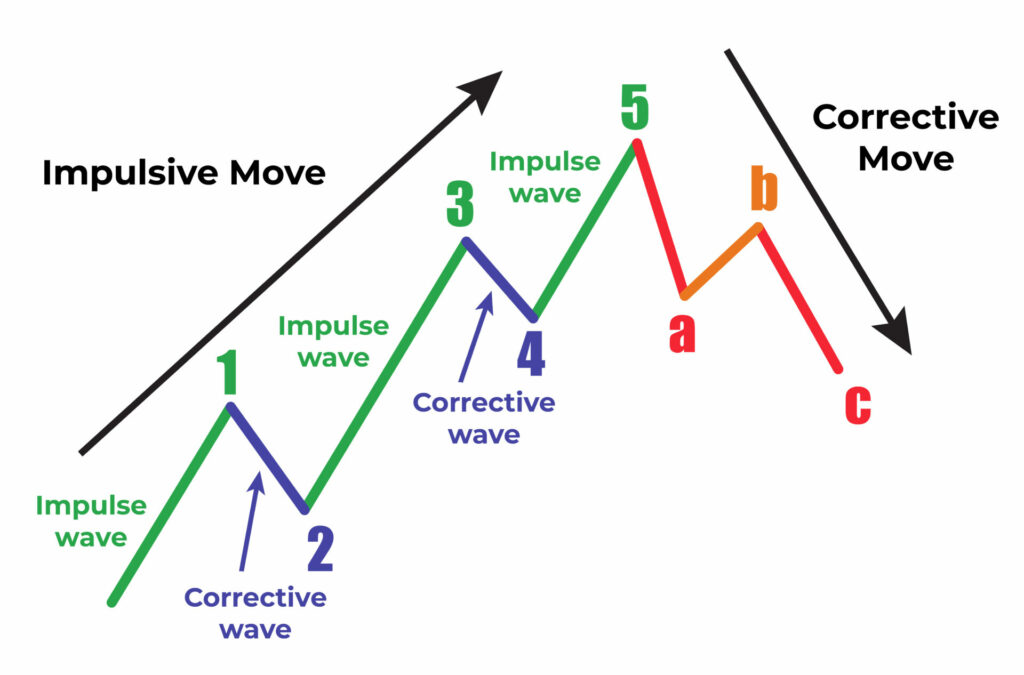

At its core, Elliott Wave Theory is based on the idea that markets move in predictable cycles driven by crowd psychology. These movements follow a five-wave impulse structure (trending market) and a three-wave corrective structure (pullbacks).

The Five-Wave Impulse Pattern (Bull & Bear Cycles)

1️⃣ Wave 1 – The beginning of a new trend, often fueled by smart money accumulating.

2️⃣ Wave 2 – A pullback where weaker hands exit, believing the move is over.

3️⃣ Wave 3 – The most powerful wave, driven by institutional interest and retail FOMO.

4️⃣ Wave 4 – A short correction before the final push.

5️⃣ Wave 5 – The last euphoric move before the market enters a more significant correction.

Once the five-wave cycle completes, a market typically corrects in three waves (A-B-C) before resetting and starting a new cycle.

🚀 How the AI Algorithm Helps: It scans and identifies where we are in the cycle in real-time, allowing traders to enter precisely the right moment—before the crowd.

Wyckoff Theory: Spotting Market Manipulation Before It Happens

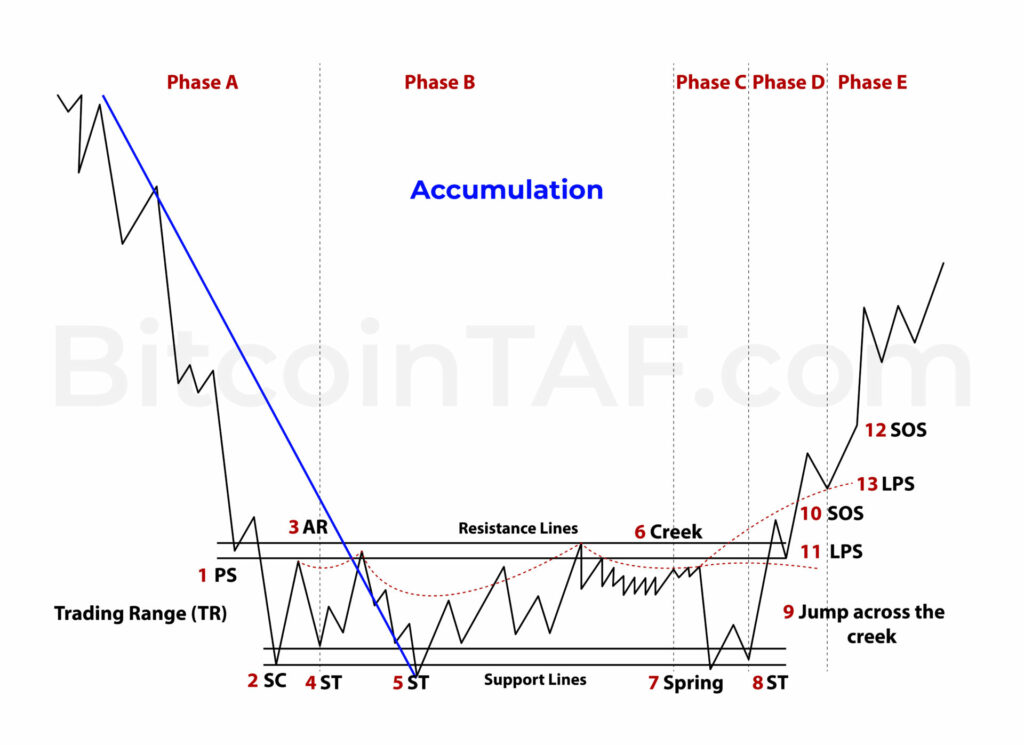

To understand why markets move the way they do, traders must study Wyckoff’s Accumulation & Distribution Model—a blueprint for market manipulation that smart money follows.

🔹 Accumulation Phase – Large players (institutions, whales) quietly buy low-price assets, creating a sideways trading range while retail traders remain fearful.

🔹 Mark-Up Phase—Once enough accumulation occurs, Prices begin rising in an Elliott Wave structure, trapping those who doubted the rally.

🔹 Distribution Phase – At the top, smart money sells into strength, unloading their positions while retail traders chase the rally.

🔹 Mark-Down Phase – The market corrects, wiping out late buyers before restarting the cycle.

🚀 How the AI Algorithm Helps: By analyzing Wyckoff patterns in real-time, our AI can detect whether the market is in accumulation (buy opportunity) or Distribution (exit warning).

Training is the Key to Success

Using the Elliott Wave AI Algorithm and BitcoinTAF indicators without proper training is like flying blind. The most successful traders invest in education first.

💡 Recommended Training Courses:

📘 HODLFIRE Indicator Training – Learn how to use the HODLFIRE Top & Bottom Pivot Points effectively.

🔗 Enroll Here

📘 Ultimate Day Trade Training Course – Master the Detonator ABC Indicator and build a strong trading foundation.

🔗 Enroll Here

These courses provide a considerable advantage, teaching traders to identify the best market entries and exits, use the HODLFIRE and Detonator indicators effectively, and apply the Elliott Wave Theory confidently.

How to Profit from This Knowledge

With the Elliott Wave AI Algorithm and BitcoinTAF’s indicators, traders can:

💰 Enter at the bottom of Wave 2 or Wave 4, maximizing gains before the explosive moves.

💰 Avoid buying at the top of Wave 5, preventing unnecessary losses.

💰 Identify key Wyckoff Accumulation zones, getting in before the whales pump the market.

💰 Spot major corrections before they happen, securing profits and re-entering at better levels.

The crypto bull market is approaching, and those who fail to recognize these cycles will be left chasing pumps instead of leading them.

Why NOW is the Time to Act

🔹 Global liquidity is rising.

🔹 Institutional adoption is accelerating.

🔹 Market cycles are aligning for the next explosive move.

🔹 AI-powered trading is the future—and those who use it gain the ultimate edge.

📢 Are you ready to stop guessing and start trading like a pro?

👉 Subscribe now and gain access to the Elliott Wave AI Algorithm today:

🔗 Join here

Written by

Marius Landman

Do we get to keep the indicator after the course finishes? Thanks.

Hi Kim. The Detonator Indicator as well as the HODLNATOR Indicator both come with the purchase of the respective courses. After your course expires, you can opt for a cheaper add-on option for the indicators alone. These add-on options appear in our online store after the purchase of one of the courses. We hope to see you soon! The BitcoinTAF Team